Fed Inheritance Tax 2025

Fed Inheritance Tax 2025. It will rise to $13.61 million in 2025 (up from $12.92 million in 2025). Do you have to pay a federal tax on inheritance?

In 2025, the federal estate tax ranges from 18% to 40%, depending on how much the value of the estate exceeds the current exemption limit of $13.61 million. For people who pass away in 2025, the exemption.

Tax Rates 2025 Vs 2025 Printable Forms Free Online, Estates below this value are not subject to federal estate.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

Why the inheritance tax police might pay you a visit, Estates below this value are not subject to federal estate.

Inheritance tax threshold Everything you need to know, Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount.

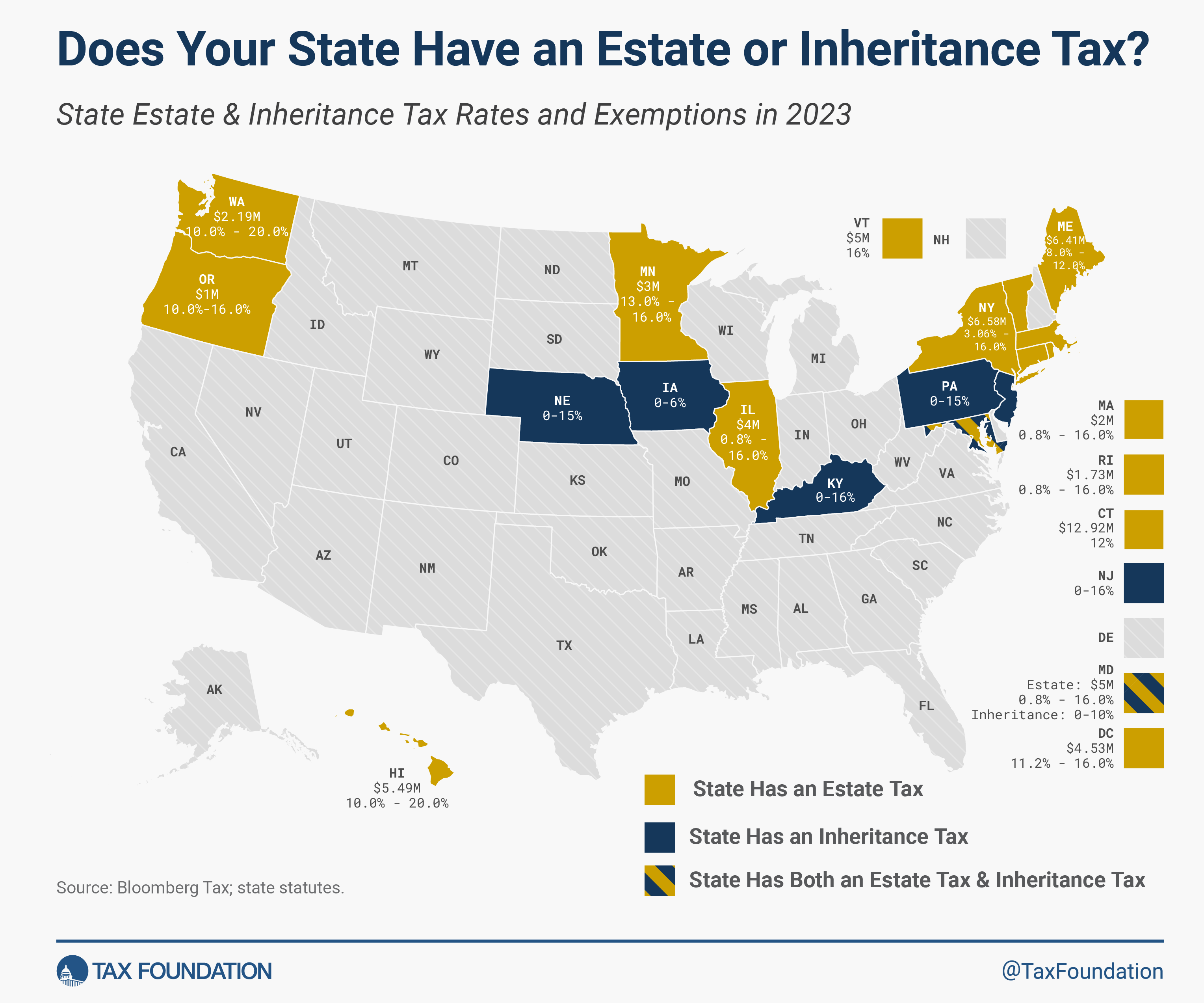

2025 State Estate Taxes and State Inheritance Taxes, There's no federal inheritance tax so your inheritance amount doesn't have to be reported to the irs.

5 Strategies for Reducing Inheritance Tax Werner Law Firm, Inheritance tax other states, such as pennsylvania and new jersey, impose an inheritance tax, which taxes property transferred at death based on the relationship of the.

Is the Inheritance Tax mortgage loophole real? Elsby & Co, In 2025, the federal estate tax ranges from 18% to 40%, depending on how much the value of the estate exceeds the current exemption limit of $13.61 million.

Death of inheritance tax? Financial Planning in Wimbledon, There is no federal inheritance tax.

Inheritance Tax Planning & Advisory Sterling Wells Accountants, In 2025, the exemption amount for individual estates will reach $13.61 million, an increase from the $12.92 million benchmark in 2025.

3102.5k Salary After Tax Example CA Tax 2025, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.